My automated approach to budgeting and saving

Published: 30 Mar 2021

Modified: 30 Mar 2021

Personal Finance

Finance

Investing

Budgeting 💰

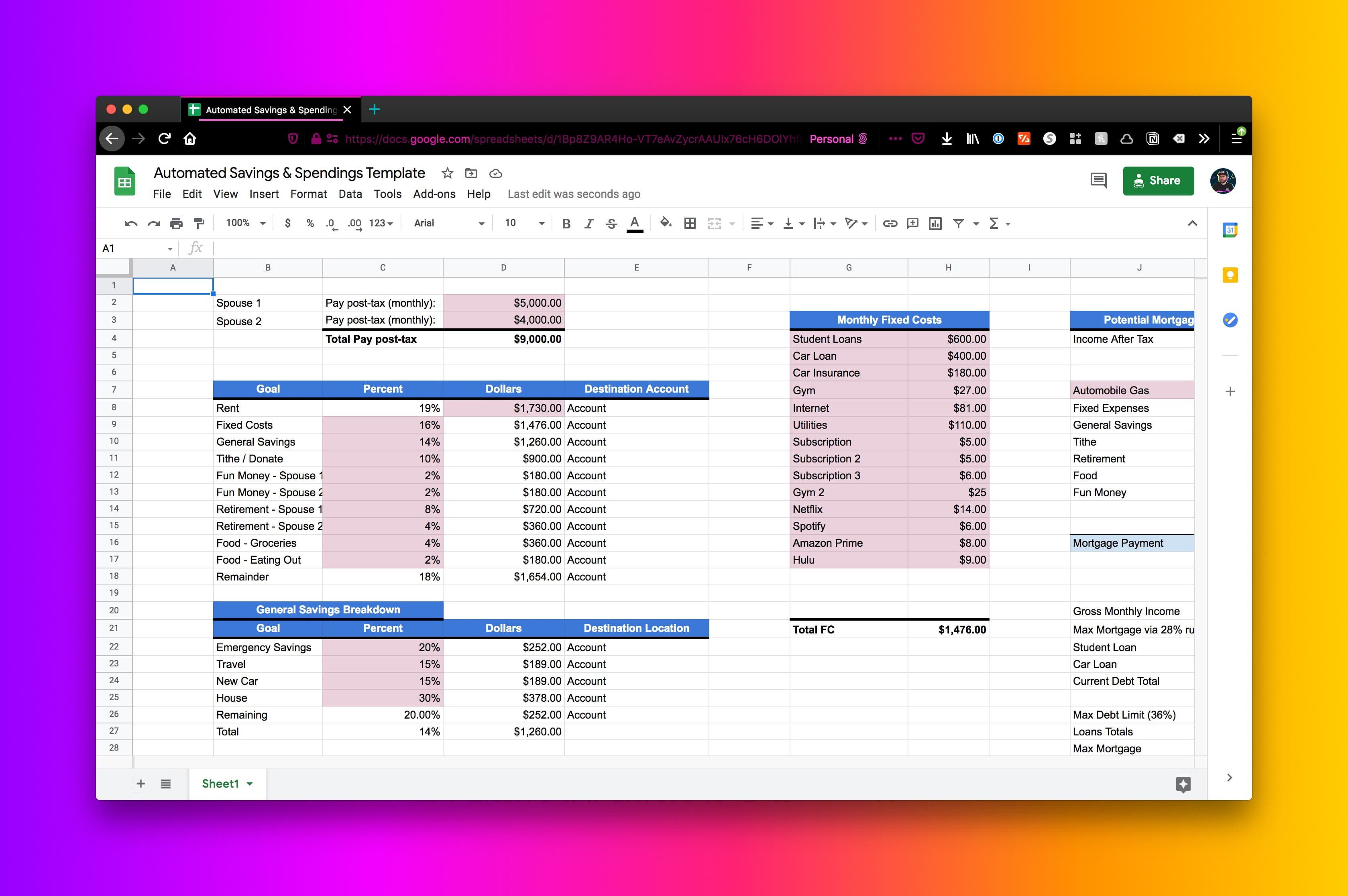

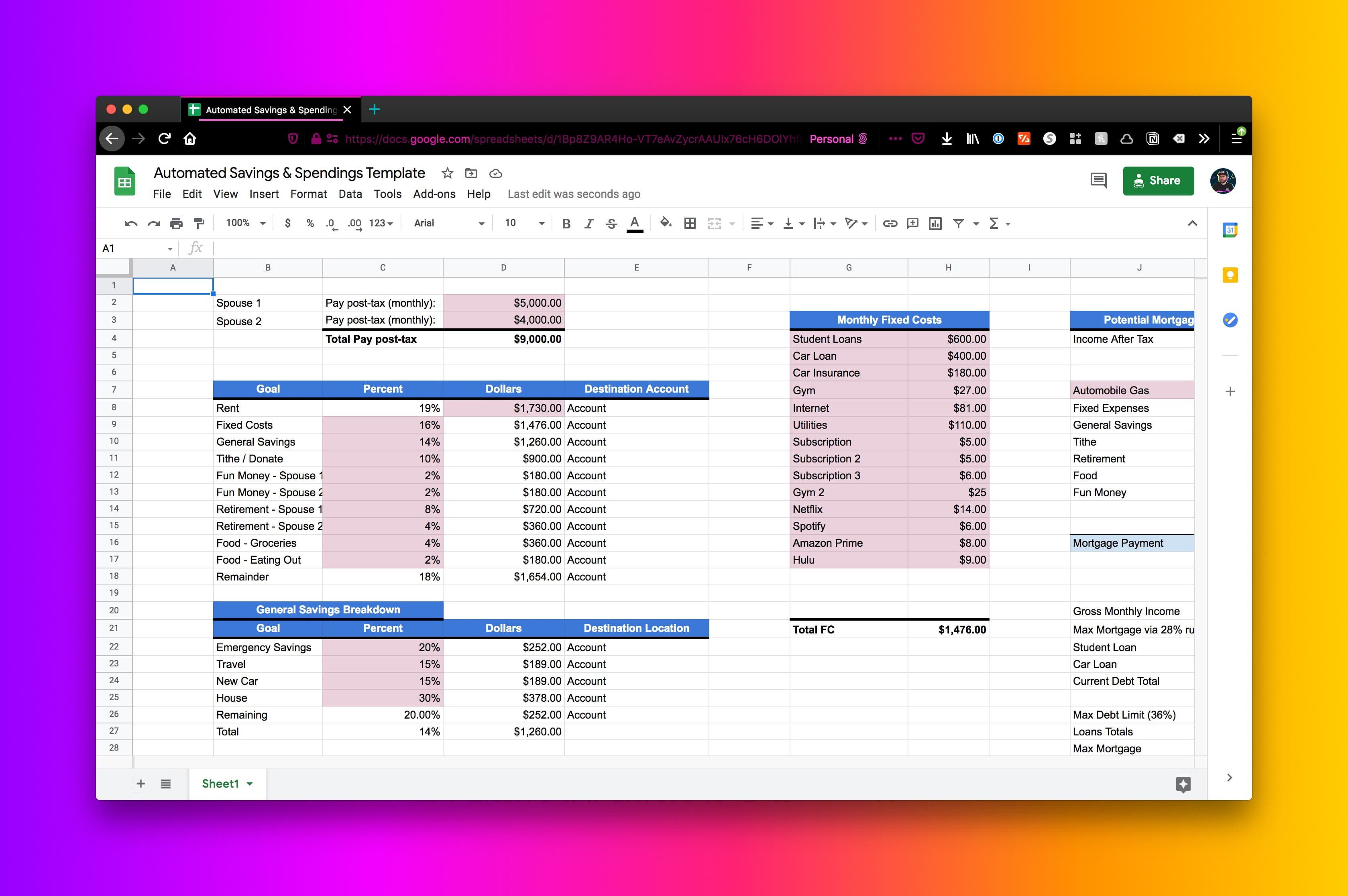

Yup. That b word that everyone hates. I know what you are thinking, time to close this tab and go back to doomscrolling Twitter - well before you do that, hear me out. I hate budgeting too. So think of this as a "less painful way to save money and automate stuff so you can browse twitter more often". So here's my strategy, that might help you optimize savings and have minimal headaches and pain along the way. (And stay tuned for a spreadsheet template that you can use based on what I use for ours). Basically I try to automate things as much as possible in an efficient manner that requires minimal maintenance each month.

Oh and to keep those lawyers happy: none of this is financial or investing advice. It's just our experience. Your actual investing and financial situation will be different and you should consult a licensed financial expert before acting.

The Goal 🎯

The goal for my budget is to spend as little time on it as possible, with the maximum return. I want things automated and easy. I'm not a rate chaser - so while there might be ways to fudge out another 0.00005%, I'm not doing that. I'm all about making it easy and hands off. Aka I want to be doing this:

While the money does this:

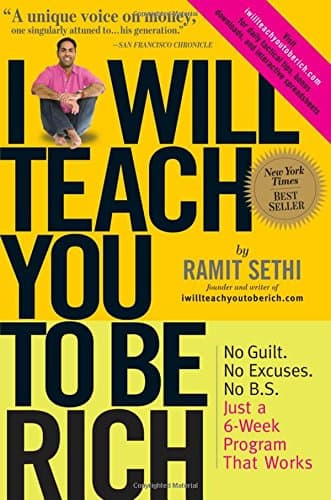

The Book 📕

I read "I will teach you how to be rich" like 10 years ago and it was much of the inspiration for our automatic savings plan. Honestly the title of that book is pretty misleading and almost turned me off. But to the author "rich" wasn't like "I'm rich bitch" but more like "I'm meeting my financial goals and am happy about it". I'd absolutely recommend it to anyone, especially us millennials who were taught by society that credit cards "are the devil" and "you should manually budget your money each month". I legitimately own 3 copies of the book so that I can loan them out to friends. You could actually probably stop reading my blabber right now and just go read the book. And he talks about way more than just budgeting, its about personal finances and lots of other stuff related to money.

And he recently came out with version 2 and I'm about 40% through it - it's also very helpful!

His plan around budgeting is pretty simple at it's core - you should setup buckets for spending and savings and any leftover funds you can enjoy spending guilt-free. This is a great concept that takes up front work but once you are done, you can party like its 1999! There's a lot of freedom in this approach versus traditional budgeting I think.

One real life example - for years I've been putting small amounts into my photography savings bucket. Recently I got a new camera and was able to pay for it completely out of my Photography savings bucket having saved over $2,000 in the last 3-5 years.

My self talk went like this "Okay after several weeks of endless youtube videos and research I'm finally ready to buy this fuji xt4. But it's $1600 new, how will my partner go for this?! Oh wait, I have a savings bucket and it has $2,000 in it. Hey partner, I've saved enough to pay for this out of my photography savings, its cool if I buy it right? Sweeeet, party time!" (Wow, okay that sounded way cooler in my head).

The Budget Spreadsheet 🔢

I'm no spreadsheet wiz so it's pretty straight forward and basic. Basically it takes in our income and then we've setup percentages of our income that goes towards certain savings goals and expenses. It helps me automate the savings so we don't have to think about it each month.

Budget Allocations

Fixed Costs

These are reoccurring costs that don't change each month - like the 17 streaming services that it seems like we need to watch any type of television programs. The goal with a good budget is minimizing these costs. And actually the biggest fixed cost is your housing, and most finance advisor type folks say reducing that overhead monthly cost should be your top priority. (Alas, you may notice ours is higher than sometimes advised... Sadly I live in one of the world's hottest real estate markets, Seattle WA, so its darn near impossible to get it any lower. 😢)

General Savings

This is a general category of savings with subcategories like Emergency savings, traveling, new car, house and leftover savings.

How spending works

This is how spending works with our budget:

- For fun money we each have our own credit card that is paid in full each month via our fun money spending account. Alternatively we can also use the debit card associated with the fun money checking account.

- Other credit cards are paid off in full each month from our joint checking account.

- If we have big expenses that are relevant to one of the savings accounts, we often pay with a credit card. And if so, I then move the funds from the savings account into the joint checking account.

The Great Bank Saga of 2021 🏦

Oh it was a saga. In early 2021, my greatest fears and nightmares came true - the parent owner of Simple Bank, announced it was getting closed. Argghhhhhh why?! Simple Bank was by far the best bank when it came to customer experience, features, UI, apps, websites, and pretty much any other category. So I spent hours researching replacements. I even joined a discord where hundreds of other ex-Simple customers were also trying to find a good replacement. This saga could probably be its own blog post but I'll give you the cliffnotes. Alas, I couldn't find a bank that matched Simple's for it's amazing customer experience and UI and feature set. I opened accounts at One Finance, Wealthfront Cash, Zeta, Monzo, amongst others and revisited banks like Ally, Betterment, SoFi, and half a dozen other Neo Banks*.

No - not that Neo, here's the real definition for Neobank. Do not fear, you aren't that far behind the bank categorization terminology curve, I just learned Neobank a few months ago (even though I've been partially obsessed with them for years). The good news is now you can be a super hipster dufus and drop that into a casual chat with your housemates like the up to date financial whiz that you are now are. You are welcome.

I finally ended up at HM Bradley, a bank I initially didn't consider mainly due to the name. It sounds like an ancient, and therefore not modern nor relevant, bank. But it's actually a new Neo-Bank and one that handsomely rewards saving with interest rates of up to 3%. I liked their UI the more I used it (cough UI snob cough), and while it's no Simple, it beat out all the rest of the banks with its modern UI, multiple account types (joint and individual), and feature set. It will do for now until Monzo USA reaches parity with Monzo UK (which is the most exciting bank prospect for me) or until Wealthfront opens a real joint cash account (right now the secondary owner can only view the joint account 🙈😢).

Which brings me to Wealthfront, and why they are now my top financial institution (rip Simple 😢). Here's why:

Our Savings Plan

For medium and long term savings I used to use (and love) ING Direct (which was purchased in 2012 by Capital One and turned into Capital One 360). I loved them because they allowed you to setup many 'sub accounts' and paid a high interest rate. So I had savings accounts for new cars, photography gear, a new road bike, traveling, etc.

In general I prefer online-only banks and high interest savings accounts like this one because they are generally low free and high interest. However the past few years it seemed like the mothership at Capital One has lacked a general strategy with Capital One 360 and it hasn't gotten a lot of love. At one point they seemed they were going to fold the accounts into Capital One but never did - so it seems like an subsidiary that's kind of in limbo. The accounts still operate fine and everything but they just don't get much love from Capital One so I moved on.

My current residence for our savings is one of my favorite financial institutions (oh if you couldn't tell, I'm super nerdy about finance firms), Wealthfront. Wealthfront is what's called a "robo-advisor" platform - a fancy word for a company that uses computers and algorithms to invest in low cost index funds that is super hands off and can save you money. In addition to their robo advisor platform, which invests in the stock market, they even recently added some high yield savings and checking accounts! Having a college degree in Economics and worked at Fidelity and Capital One, I used to manage my own investments. But after a few years I realized I never ever checked them. I knew that doing regular portfolio rebalancing was vital to their success but I just never did it. So that's why I switched to Wealthfront from Fidelity a few years ago. Wealthfront is an amazing "set and forget it" type style of investing. And they focus on low cost index funds so you can matching market performance with the additional costs of being an actively managed mutual fund. It kind of feels like riding in a Tesla on autopilot compared to a stick shift Honda from the 90s. On top of that their UI is fantastic, mobile apps lead the game, and feature set is very robust. It's pretty much a match made in heaven for a hands off, tech nerdy dude like me. Also their fees are very low, charging just 0.25% on assets (See the link below to get $10,000 managed for free).

So I've setup about 10 different accounts with them for our savings goals. Each account has a different risk profile depending on time horizon. Some of them are cash savings accounts (shorter term needs) and some are investment accounts (longer term savings goals).

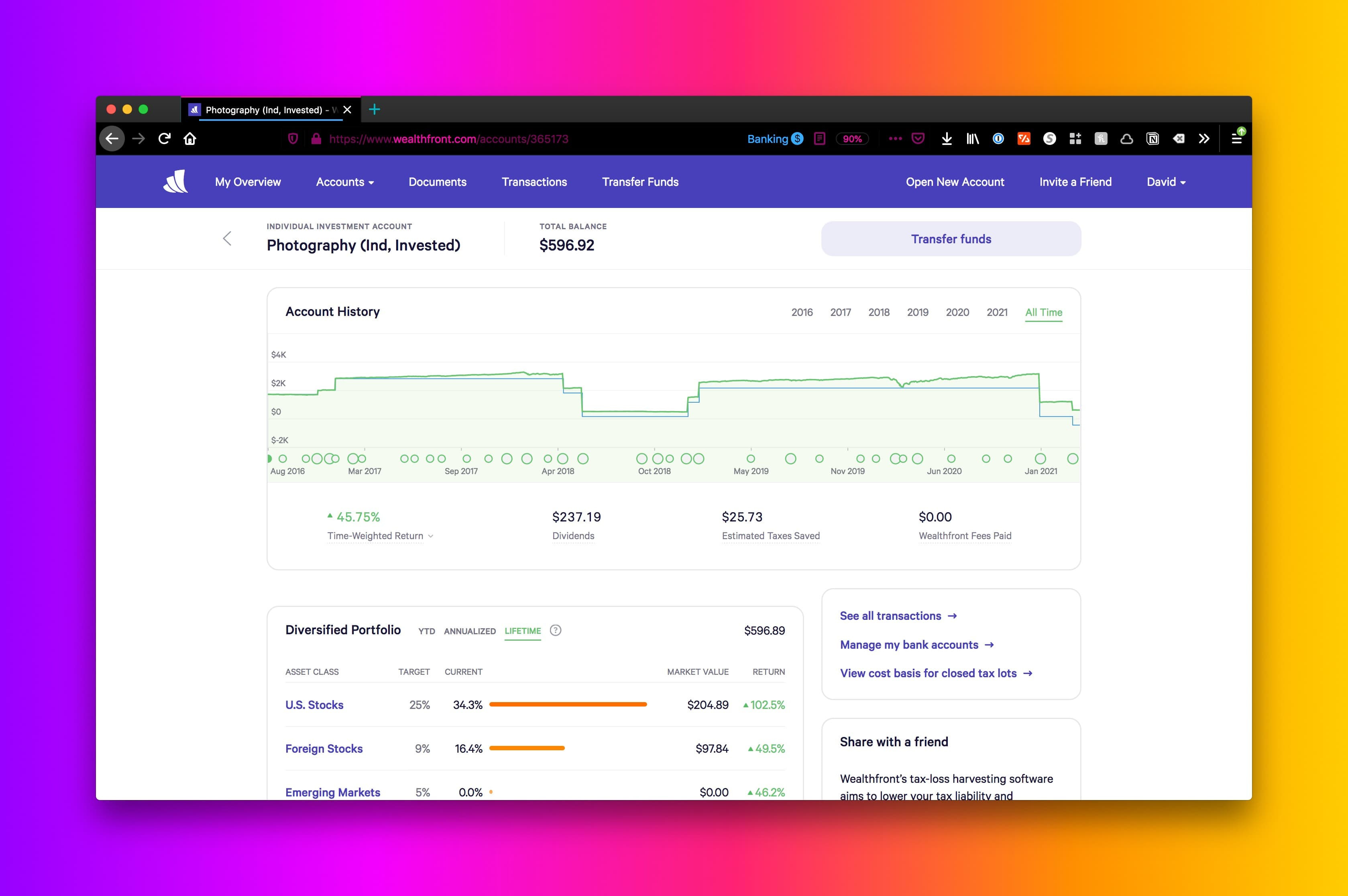

As an example, here's a screenshot of my photography fund account:

Translation: we have accounts where we won't need the cash for 5-10 years invested in more risky investments and cash accounts/accounts invested with a lower risk profile where we might need the funds in less than 5 years.

10/10 would recommend. Yes I love Wealthfront. And you should too 😀.

Once they open real joint checking accounts, I'm also moving our bank accounts there. That pretty UI and feature set is just too good! ✨ If this sounds like something you might like, you can use this referral link to get an extra $5,000 managed for free (on top of the initial $5,000 they manage for free).

Example accounts of our savings buckets at Wealthfront

- Puppy fund

- Long term house improvements

- Short term house fund

- Globetrotting fund (traveling)

- New car/automobile fund

- Rainy day/emergency savings fund

- Photography fund

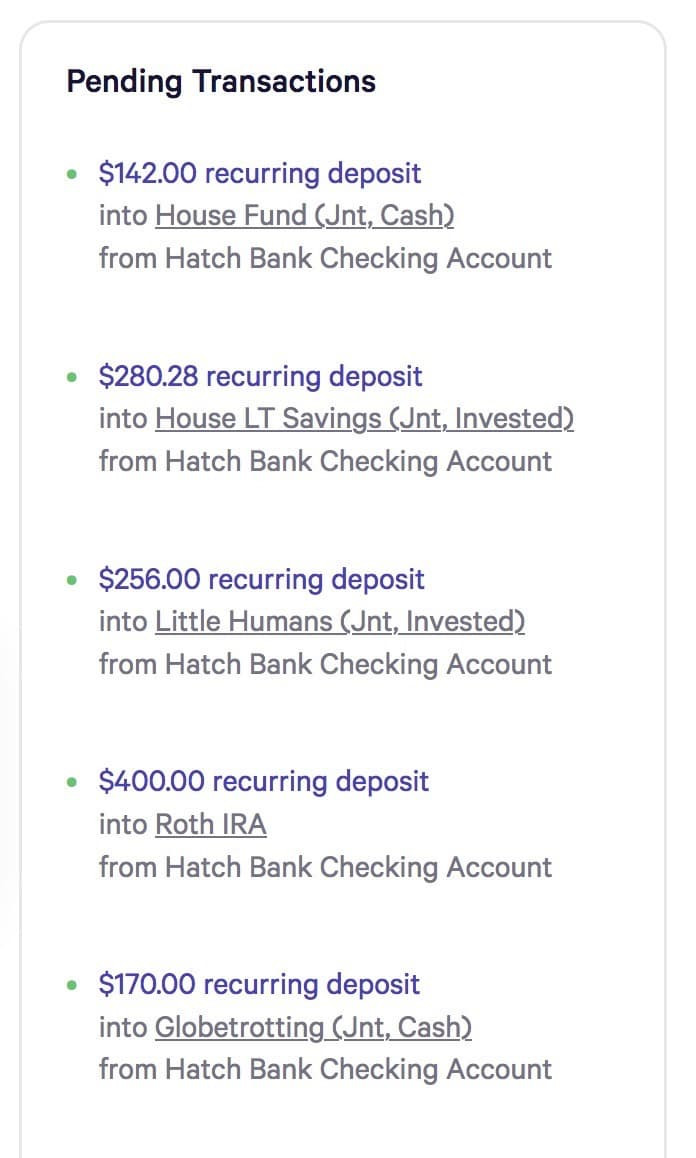

What I did was take those percentages from the spreadsheet, adjust them to my liking and then set up automatic transfers into these Wealthfront accounts. This way its all automated and I'm not doing much to manage the savings each month. Typically I pay for all our costs via credit cards to maximize our rewards points, and subsequently pay them off in full each month. In that first example where I got a new camera, I paid for it with my credit card and then withdrew the funds from my photography savings account into our main joint checking account that is used to pay off the credit cards. With fun money, we each have our credit cards that are autopaid from our individual accounts - so I use a separate credit card for fun money transactions.

Example of our reoccurring deposits:

Retirement savings

This could be a whole new post but here's the details from a concorde height flyover: we try to save and invest at least 10% of our income into retirement through workplace plans and our own IRA's. Due to our time horizon (aka retirement is super far away), most of our investments are in equity funds. Retirement is super super super important and the sooner you start, the better. Plus Wealthfront makes it darn easy to have that on autopilot as well!

El Fin

What do you think about the b word now? Do you remember what a Neobank is? Let me know on twitter!

member of the weird wide webring:

proudly uses statamic, tailwind css, & fathom analytics

built with ❤️ in the rainy PNW | © david a lindahl